The AI Smart Instrument industry is experiencing unprecedented growth with orders surging 40% year-over-year, largely driven by a remarkable 90% domestic chip substitution rate that's reshaping the global instrumentation landscape. This dramatic shift represents more than just market statistics - it signals a fundamental transformation in how Smart Instrument technology is developed, manufactured, and deployed across industries. The combination of artificial intelligence integration and domestic semiconductor independence has created a perfect storm of innovation, cost reduction, and supply chain resilience that's attracting massive investment and adoption across manufacturing, healthcare, energy, and research sectors worldwide.

The Domestic Chip Revolution in AI Smart Instruments

The 90% domestic chip substitution rate in AI Smart Instrument manufacturing represents a seismic shift in the global semiconductor landscape ??. This isn't just about replacing foreign components - it's about creating entirely new architectures optimised specifically for intelligent instrumentation applications. Domestic chip manufacturers have developed specialised processors that integrate AI acceleration, real-time data processing, and ultra-low power consumption into single packages designed specifically for smart instruments.

What makes this achievement particularly impressive is the speed at which it's been accomplished. Just three years ago, domestic chips represented less than 15% of components in Smart Instrument applications. The rapid advancement in domestic semiconductor capabilities has been driven by massive R&D investments, strategic partnerships between chip designers and instrument manufacturers, and government initiatives supporting technological independence ??.

The performance benefits are tangible and measurable. Domestic chips designed specifically for AI instrumentation deliver 30-50% better power efficiency compared to general-purpose foreign alternatives, while offering superior integration with AI algorithms and real-time processing capabilities. This optimisation translates directly to longer battery life, faster response times, and more sophisticated analytical capabilities in field deployments.

Market Dynamics Driving 40% Order Growth

The explosive 40% growth in AI Smart Instrument orders reflects multiple converging market forces that are fundamentally reshaping industrial automation and measurement technologies ??. Primary drivers include the urgent need for predictive maintenance capabilities, environmental monitoring requirements, and the push towards Industry 4.0 implementations across manufacturing sectors.

Cost advantages from domestic chip integration have made Smart Instrument technology accessible to mid-sized companies that previously couldn't justify the investment. The 25-35% cost reduction achieved through domestic semiconductor substitution has democratised access to AI-powered instrumentation, expanding the addressable market significantly beyond traditional large enterprise customers.

Supply chain resilience has become a critical factor in purchasing decisions. Companies that experienced disruptions during recent global supply chain crises are prioritising suppliers with domestic component sourcing. The 90% domestic chip substitution rate provides customers with confidence in long-term availability and stable pricing, driving preference for domestically-integrated solutions ???.

Industry Applications and Use Cases

| Industry Sector | Traditional Instruments | AI Smart Instruments |

|---|---|---|

| Manufacturing | Reactive maintenance | Predictive analytics |

| Healthcare | Manual data collection | Automated diagnosis support |

| Energy | Periodic inspections | Continuous monitoring |

| Environmental | Basic measurements | Intelligent trend analysis |

Manufacturing facilities are leading adoption of AI Smart Instrument technology, particularly in automotive, aerospace, and electronics production where precision and reliability are paramount ??. These instruments can detect microscopic variations in production processes, predict equipment failures weeks in advance, and automatically adjust parameters to maintain optimal quality levels.

Healthcare applications represent the fastest-growing segment, with AI-powered diagnostic instruments providing real-time analysis capabilities that were previously available only in specialised laboratories. Point-of-care testing devices equipped with domestic AI chips can perform complex analyses in minutes rather than hours, revolutionising patient care in remote and resource-constrained settings ??.

Environmental monitoring has been transformed by Smart Instrument networks that can detect pollution patterns, predict weather changes, and identify environmental threats with unprecedented accuracy. These systems are particularly valuable for industrial facilities required to maintain strict environmental compliance standards ??.

Technical Innovations and Performance Improvements

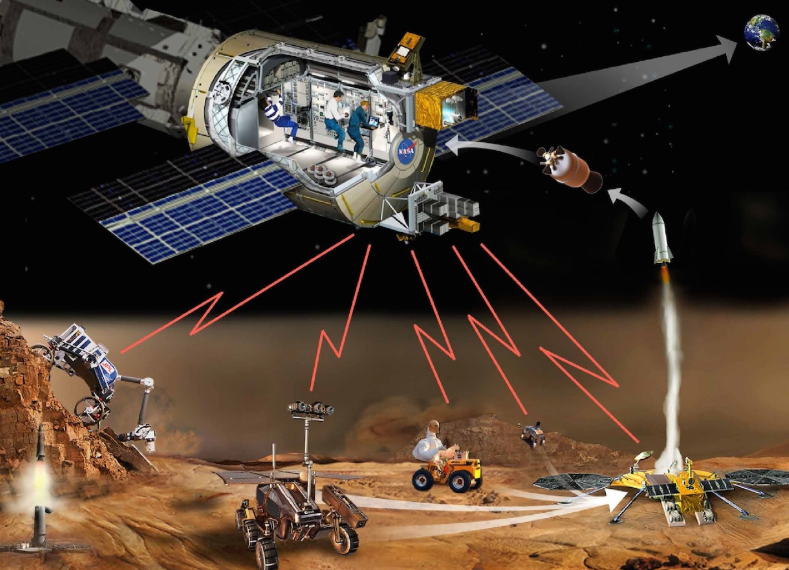

The technical capabilities enabled by domestic AI chip integration in AI Smart Instrument systems are genuinely revolutionary ??. Edge computing capabilities allow instruments to process complex algorithms locally, reducing latency and improving reliability in environments where network connectivity might be intermittent or unreliable.

Machine learning models can now run directly on instrument hardware, enabling real-time pattern recognition, anomaly detection, and predictive analytics without requiring cloud connectivity. This local processing capability is particularly valuable in industrial environments where data security and real-time response are critical requirements.

Power efficiency improvements have extended battery life in portable instruments from days to weeks, while wireless communication capabilities enable seamless integration with existing facility management systems. The combination of longer battery life and improved connectivity has made wireless sensor networks practical for large-scale deployments ?.

Economic Impact and Market Projections

The economic implications of the Smart Instrument market expansion extend far beyond the immediate 40% order growth ??. Downstream effects include job creation in high-tech manufacturing, increased demand for skilled technicians, and the development of entirely new service industries focused on AI instrument maintenance and optimisation.

Market analysts project that the current growth trajectory will continue, with annual growth rates of 35-45% expected over the next three years. The combination of domestic chip availability, improving AI capabilities, and expanding application areas creates a sustainable foundation for continued expansion.

Export opportunities are emerging as domestic AI Smart Instrument manufacturers gain recognition for quality and innovation. International customers are increasingly interested in alternatives to traditional suppliers, particularly those offering advanced AI capabilities at competitive prices with reliable supply chains ??.

Challenges and Future Developments

Despite the remarkable success in achieving 90% domestic chip substitution, the AI Smart Instrument industry faces ongoing challenges that require continued innovation and investment ??. Advanced packaging technologies, particularly for high-frequency and high-power applications, remain areas where further development is needed to match the performance of leading international alternatives.

Talent development represents another critical challenge. The rapid growth in demand for AI-enabled instruments has created a shortage of engineers with expertise in both artificial intelligence and instrumentation design. Educational institutions and industry partnerships are working to address this gap through specialised training programmes and certification courses.

Standardisation and interoperability remain important considerations as the market expands. While domestic chip substitution has provided supply chain benefits, ensuring compatibility with international standards and existing systems requires ongoing attention to maintain export competitiveness and customer satisfaction ??.

Investment Opportunities and Strategic Partnerships

The convergence of AI technology and domestic semiconductor capabilities has created unprecedented investment opportunities in the Smart Instrument sector ??. Venture capital firms are particularly interested in companies developing specialised AI algorithms for niche instrumentation applications, where domain expertise can create significant competitive advantages.

Strategic partnerships between chip manufacturers, software developers, and instrument producers are becoming increasingly common. These collaborations enable faster development cycles, better integration between hardware and software components, and more comprehensive solutions for end customers ??.

Government support programmes continue to provide funding for research and development initiatives, particularly those focused on advancing domestic semiconductor capabilities and AI algorithm development. These programmes are creating opportunities for smaller companies to participate in the growth of the AI Smart Instrument market through targeted grants and tax incentives ??.

The remarkable 40% growth in AI Smart Instrument orders, coupled with the achievement of 90% domestic chip substitution, represents a watershed moment for the global instrumentation industry. This success demonstrates that technological independence and market leadership can be achieved simultaneously through focused investment in research, development, and manufacturing capabilities. As AI technology continues to evolve and domestic semiconductor capabilities advance further, the Smart Instrument sector is positioned for sustained growth that will benefit manufacturers, customers, and the broader technology ecosystem. The foundation has been laid for a new era of intelligent instrumentation that combines cutting-edge AI capabilities with reliable, domestically-sourced components ??.