Scouring financial sites for Figure AI Stock Price Today? Here's the billion-dollar truth: you won't find it ticker symbol anywhere. As one of artificial intelligence's most valuable private ventures, this humanoid robotics pioneer is reshaping manufacturing floors while remaining tantalizingly inaccessible to public investors. While their workforce robots master complex tasks autonomously through breakthrough AI, market access remains strictly limited to elite backers. We unpack what makes this $2.6B behemoth different from public AI stocks, when retail investors might finally get a chance, and why tech titans like OpenAI and Jeff Bezos are betting fortunes on its factory revolution.

Why You Can't Buy Figure AI Stock (For Now)

Unlike publicly traded companies such as Nvidia or Tesla, Figure AI Stock Price Today doesn't exist on NYSE or NASDAQ. February 2024's $675 million funding round solidified its unicorn status through private investment. These closed-door transactions involving Microsoft, OpenAI Startup Fund, and Bezos Expeditions created its current $2.6 billion valuation while deliberately avoiding public markets.

Three core barriers shield public access:

Pre-IPO Status: No S-1 filings with SEC

Strategic Capital Curation: Only 6% of shares allocated to retail-equivalent funds

Revenue Reinvestment Priority: BMW partnership profits fuel R&D, not dividends

Decoding the Hype Behind Figure's $2.6B Valuation

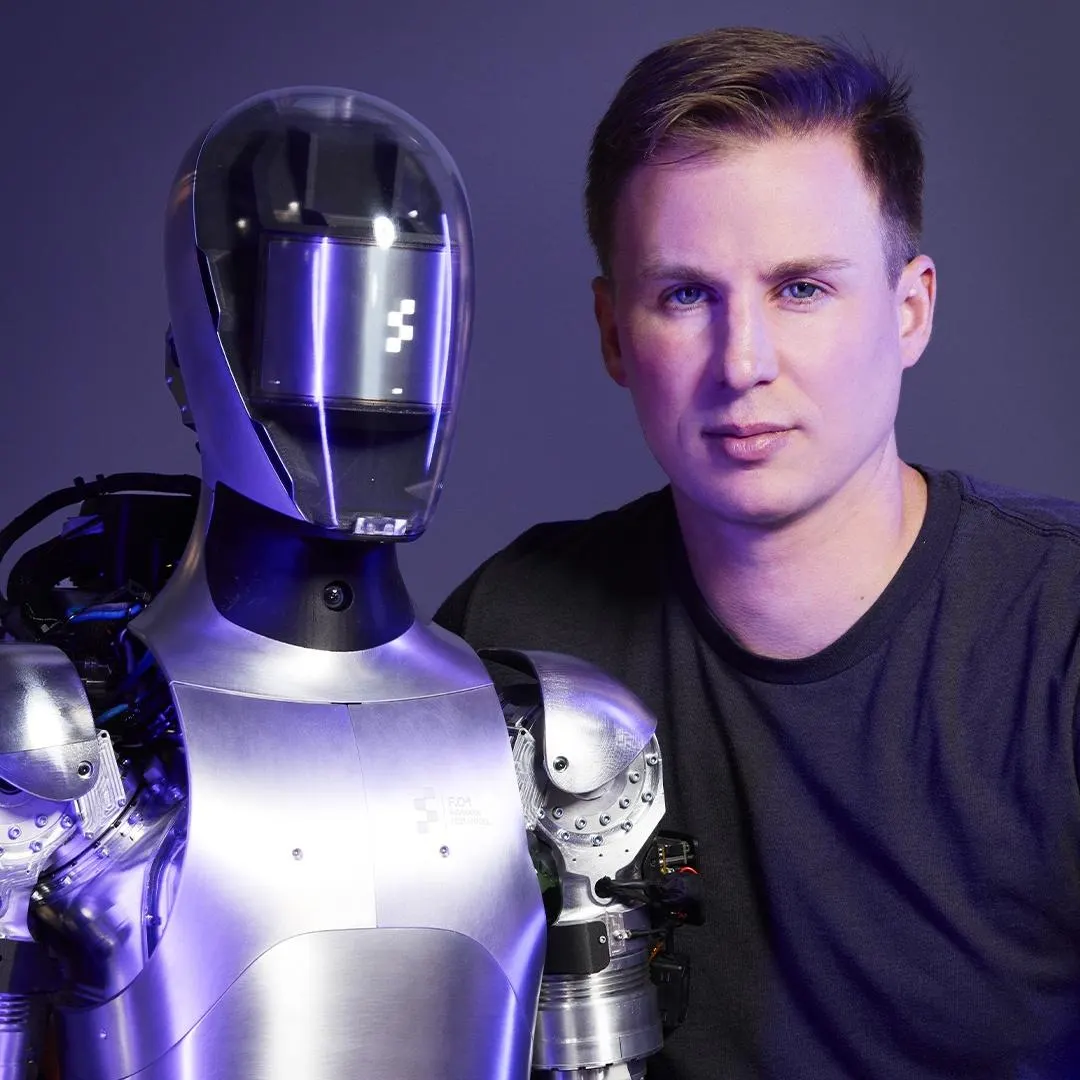

Technology Milestones Driving Value

Unlike speculative AI ventures, Figure hit these tangible benchmarks in Q1 2024:

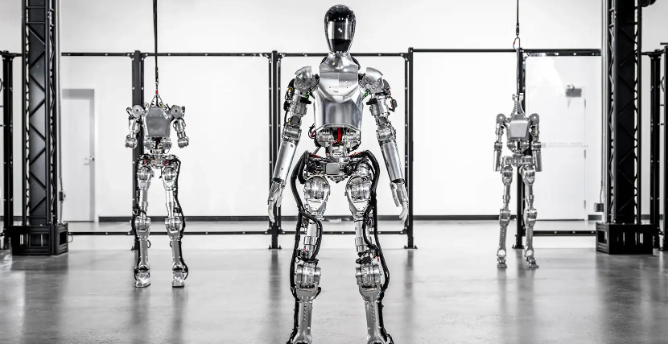

First humanoid robot to perform autonomous factory work (February demo)

AI neural net mastering 5 complex tasks weekly

Real-time environment adaptation in unstructured settings

Partnerships Creating Revenue Path

Strategic alliances provide more than cash:

BMW Manufacturing (physical testing labs + order pipeline)

Microsoft Azure (cloud infrastructure for neural nets)

OpenAI (multimodal learning architectures)

Timeline to IPO: Analyst Predictions

| Phase | Estimated Window | Triggering Events |

|---|---|---|

| Series D Funding | Late 2025 | Commercial deployment at 5+ BMW plants |

| Regulatory Preparation | 2026 | SEC pre-filing consultations |

| IPO Launch | Q2-Q3 2027 | Consistent quarterly revenue from 3 industries |

JPMorgan analysts note: "Robotics IPOs require proven scaling capacity. Figure's current 3-year horizon depends on demonstrating error rates below 0.8% in production environments by 2026."

How Public Robotics Stocks Perform (Precedent Analysis)

When Figure eventually goes public, these robotics stocks' debut performance suggests potential patterns:

UiPath (PATH)

IPO Pop: +23% Day 1

Core Driver: Factory automation software

C3.ai (AI)

IPO Pop: +136% Day 1

Core Driver: Enterprise AI deployment

Figure Projections

Expected Range: +40-90% Day 1

Differentiator: Physical AI + humanoid form factor

Notably, robotics hardware companies trade at 30% premium to software-only peers—a key advantage for Figure AI Stock Price Today anticipation.

Getting Exposure Before The IPO

While you can't directly buy Figure AI Stock Price Today, three strategies offer indirect exposure:

Major Backers' Stocks: Invest in Microsoft (AI infrastructure provider holding equity)

Robotics ETF: BOTZ holds 8% in private equity access funds

Secondary Markets: SharesPost shows private share sales at $102/share (requires accredited status)

However, analysts caution: "Secondary market valuations currently reflect 150% premium to last funding round—high risk given typical 3-year lockups."

FAQs: Figure AI Stock Price Today

Why is Figure AI stock unavailable?

As a private company, Figure AI hasn't filed for IPO. Shares exist but trade only among approved investors.

When can I buy Figure AI stock?

Based on manufacturing milestones, late 2026 or 2027 is the earliest realistic public offering timeframe.

What's Figure AI's current stock price?

There's no public stock price. Private transactions in Q1 2024 implied ~$101/share valuation.