Are you eager to dive into the exciting world of AI and robotics investments, specifically wondering How to Invest in Figure Robotics? As a trailblazer in humanoid robotics, Figure AI is capturing the attention of investors worldwide. This article provides a comprehensive guide to investing in this innovative company, exploring indirect investment options and broader opportunities in the robotics and AI sector. Whether you're a seasoned investor or a curious beginner, we'll walk you through actionable steps, unique strategies, and key insights to align your portfolio with the future of automation.

Why Invest in Figure Robotics?

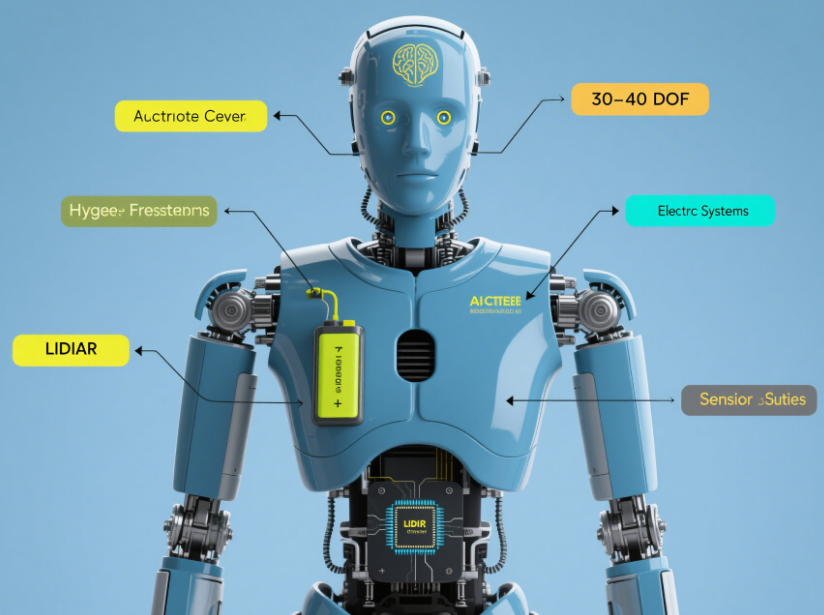

Figure AI, founded in 2022, is revolutionizing the robotics industry with its humanoid robot, Figure 01, designed to address labor shortages in industries like manufacturing, logistics, and retail. With a valuation of $2.6 billion after a $675 million funding round in 2024, backed by giants like Microsoft, Nvidia, and Jeff Bezos, Figure AI is a private company with significant growth potential. The global robotics market is projected to reach $169.8 billion by 2032, with a 15.1% CAGR, making now a prime time to explore How to Invest in Robotics and Artificial Intelligence.

Understanding Figure AI’s Unique Position

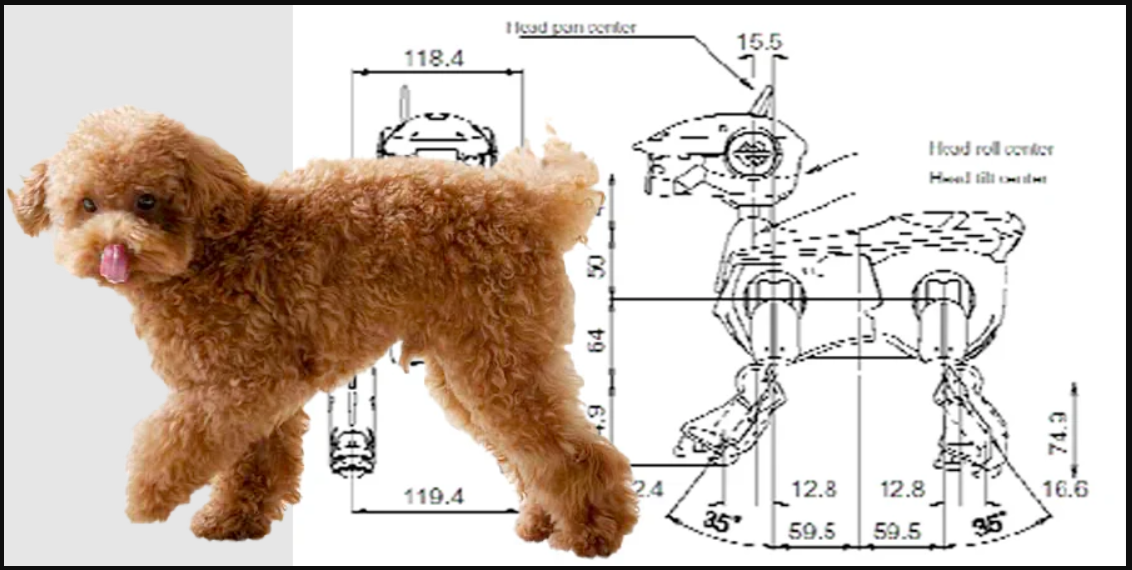

Unlike traditional robotics firms, Figure AI focuses on general-purpose humanoid robots powered by advanced AI. These robots can perform complex tasks, from warehouse operations to household chores, without pre-programming, thanks to their Helix system. This innovation positions Figure AI as a leader in Examples of Robotics in Business, particularly in automating repetitive or dangerous tasks. For investors, this translates to a unique opportunity to tap into a company addressing real-world labor challenges.

How to Invest in Figure Robotics: Step-by-Step Guide

Since Figure AI is not publicly traded, direct investment is limited to accredited investors. However, there are creative ways to gain exposure to this promising company and the broader robotics sector. Below is a detailed tutorial on How to Invest in Figure Robotics.

Step 1: Explore Private Market Opportunities

As a private company, Figure AI stock is primarily available to accredited investors through secondary marketplaces like Forge Global. To qualify, you need an annual income exceeding $200,000 or a net worth over $1 million. Register with a platform like Forge to express interest in Figure AI shares, though availability may be limited due to high demand and low supply (0.3:1 ratio as of March 2025).

Step 2: Invest in Related Public Companies

Another way to gain indirect exposure is by investing in publicly traded companies with stakes in Figure AI, such as Nvidia (NVDA), Microsoft (MSFT), or Intel (INTC). These companies have invested heavily in Figure AI, and their stock performance is tied to advancements in How to Invest in AI and Robotics. For example, Nvidia’s GPUs power Figure’s robots, making it a strong proxy investment.

Step 3: Consider Robotics and AI ETFs

Exchange-traded funds (ETFs) offer diversified exposure to the robotics sector. Consider these options:

Global X Robotics & Artificial Intelligence ETF (BOTZ): Includes leaders like Nvidia and Intuitive Surgical, with a 0.68% expense ratio.

ROBO Global Robotics & Automation ETF (ROBO): Tracks 77 companies, including Fanuc and Harmonic Drive Systems, with a 0.95% expense ratio.

First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT): Features 101 holdings, including Palantir and Cognex, with a 0.65% expense ratio.

These ETFs align with Invest in Robotics Companies, providing a safer way to capitalize on industry growth without betting on a single stock.

Explore More AI Robotics Innovations

Step 4: Monitor Figure AI’s IPO Timeline

Figure AI is likely years away from an IPO, given its focus on commercializing its product. Stay informed by following industry news and Figure’s official communications. When an IPO occurs, you’ll need a brokerage account to purchase shares directly.

Broader Opportunities: How to Invest in Robotics

Beyond Figure AI, the robotics industry offers diverse investment opportunities. Companies like Tesla (TSLA), with its Optimus robot, and UiPath (PATH), specializing in robotic process automation, are publicly traded and accessible. The global robotics market is expected to grow from $46 billion in 2023 to $286.8 billion by 2032, driven by AI advancements and labor shortages.

Robotics Companies in Emerging Markets

While Figure AI is based in California, exploring Robotics Companies in Toronto or Robotics Companies in Uganda can uncover unique opportunities. In Toronto, companies like Clearpath Robotics focus on autonomous mobile robots, while Uganda’s robotics scene is emerging with startups like Matibabu, which develops AI-driven diagnostic devices. These markets offer early-stage investment potential for those willing to take risks.

Robotics Solved Examples in Business

Robotics is transforming industries. For instance, Amazon uses robots for warehouse automation, reducing costs by 20%. In healthcare, Intuitive Surgical’s da Vinci system enables minimally invasive surgeries, improving patient outcomes. These Examples of Robotics in Business highlight the sector’s profitability and growth potential.

A Unique Angle: Investing in AI Robotics Collectibles

While not directly related to Figure AI, an unconventional investment strategy is exploring Figma Figures Price and Upcoming Figma Figures. Figma, a design platform, inspires collectible figures that tie into the AI and tech culture. These figures, often priced between $50-$200, can appreciate in value as AI and robotics gain mainstream traction. For example, limited-edition tech-themed collectibles have seen up to 300% returns in niche markets. This approach blends cultural investment with the robotics theme, appealing to enthusiasts and collectors.

FAQs About How to Invest in Figure Robotics

Can I invest in Figure AI as a non-accredited investor?

No, direct investment in Figure AI is restricted to accredited investors. However, you can gain exposure through ETFs like BOTZ or ROBO, or by investing in public companies like Nvidia or Microsoft that have stakes in Figure AI.

When will Figure AI go public?

Figure AI has not announced an IPO timeline, but experts estimate it may take several years as the company focuses on commercializing its humanoid robots. Monitor official announcements for updates.

Are robotics ETFs a safe investment?

Robotics ETFs like BOTZ and ROBO offer diversification, reducing risk compared to individual stocks. However, the sector is volatile due to rapid technological changes, so assess your risk tolerance before investing.

How does Figure AI’s technology differ from other robotics companies?

Figure AI’s Figure 01 robot uses advanced AI to perform general-purpose tasks without specific programming, unlike many single-function robots. Its human-like design and adaptability set it apart in industries like logistics and healthcare.

Conclusion

Investing in Figure AI offers a gateway to the booming AI and robotics sector, but as a private company, it requires strategic approaches like secondary marketplaces, related stocks, or ETFs. By understanding How to Invest in Robotics and exploring innovative angles like tech collectibles, you can position your portfolio for future growth. Stay informed, diversify your investments, and leverage the insights in this guide to capitalize on the robotics revolution.