The robotics industry is booming, but not all Robotics Companies Stock are created equal. 1X Robotics Stock is emerging as a standout, leveraging cutting-edge AI Mobility and Energy Efficiency to redefine the future of humanoid robotics. Unlike public giants like iRobot (IRBT) and Teradyne (TER), 1X’s unique approach, bolstered by its OpenAI Partnership, positions it as a leader in real-world adaptability. This article dives deep into why 1X outpaces competitors, exposing overvalued warehouse bots and showcasing 1X’s unmatched potential in the AI-driven mobility race.

Explore AI Robotics Innovations

Why 1X Robotics Stock Stands Out in the Robotics Industry

The robotics sector is projected to grow at a 15% CAGR through 2030, with subsectors like collaborative robotics hitting 35% annualized growth. Amid this surge, 1X Robotics Stock shines due to its focus on humanoid robots designed for dynamic environments. Unlike traditional warehouse bots, 1X’s robots adapt to unpredictable settings, from homes to industrial spaces, thanks to advanced AI integration.

1X’s AI Mobility Advantage

1X’s robots, like the NEO model, excel in AI Mobility. They use real-time data processing to navigate complex terrains, outperforming competitors like IRBT’s Roomba, which is limited to structured environments like homes. 1X’s AI enables fluid movement and decision-making, making it ideal for tasks requiring human-like agility. This adaptability sets a new benchmark for robotics applications beyond repetitive tasks.

Unmatched Energy Efficiency

Energy Efficiency is a critical factor in robotics scalability. 1X’s proprietary lightweight materials and optimized actuators reduce power consumption by up to 30% compared to competitors like Teradyne’s Universal Robots. This efficiency translates to lower operational costs, making 1X a compelling choice for industries aiming to cut energy expenses while scaling automation.

The OpenAI Partnership Moat

1X’s collaboration with OpenAI is a game-changer. The OpenAI Partnership equips 1X robots with advanced language models and learning capabilities, enabling them to process verbal instructions and learn from interactions. This moat gives 1X a significant edge over competitors like ABB, whose robots rely on less sophisticated software, limiting their adaptability in real-world scenarios.

Comparative Analysis: 1X vs. Public Robotics Companies Stock

To understand 1X’s dominance, let’s compare it with two public Robotics Companies Stock: iRobot (IRBT) and Teradyne (TER). The radar chart below rates agility, AI integration, and market readiness on a 1-10 scale, highlighting 1X’s superiority.

| Company | Agility (10) | AI Integration (10) | Market Readiness (10) |

|---|---|---|---|

| 1X | 9 | 8 | 7 |

| IRBT | 4 | 3 | 5 |

| TER | 6 | 5 | 8 |

iRobot (IRBT): Overvalued Warehouse Bots

iRobot, known for its Roomba vacuum, holds a 46% share in the robotic vacuum market but struggles with diversification. Its focus on consumer robotics limits its scalability in industrial applications. IRBT’s stock, trading at $7.95, reflects a 9.7% six-month gain but faces risks from declining market share and high R&D costs. 1X’s humanoid robots, with broader applications, expose IRBT’s overvaluation in a niche market.

Teradyne (TER): Strong but Limited

Teradyne, with a $19.6B market cap, excels in semiconductor testing and collaborative robots through Universal Robots. However, its robots lack the humanoid adaptability of 1X’s offerings. TER’s partnership with NVIDIA enhances its AI capabilities, but its focus on repetitive industrial tasks limits its scope compared to 1X’s versatile AI Mobility. TER’s modest 4% annualized sales growth pales against 1X’s projected scalability.

Read the Ultimate 1X Robotics Stock Investment Guide

The Hidden Risk in Warehouse Bots vs. 1X’s Humanoid Adaptability

Warehouse bots, like those from Teradyne’s Mobile Industrial Robots, are optimized for structured environments but falter in dynamic settings. Their reliance on predefined paths and heavy battery usage increases operational costs. In contrast, 1X’s humanoid robots adapt to varied tasks, from caregiving to logistics, reducing the hidden risks of over-specialization. This adaptability positions 1X Robotics Stock as a safer long-term investment.

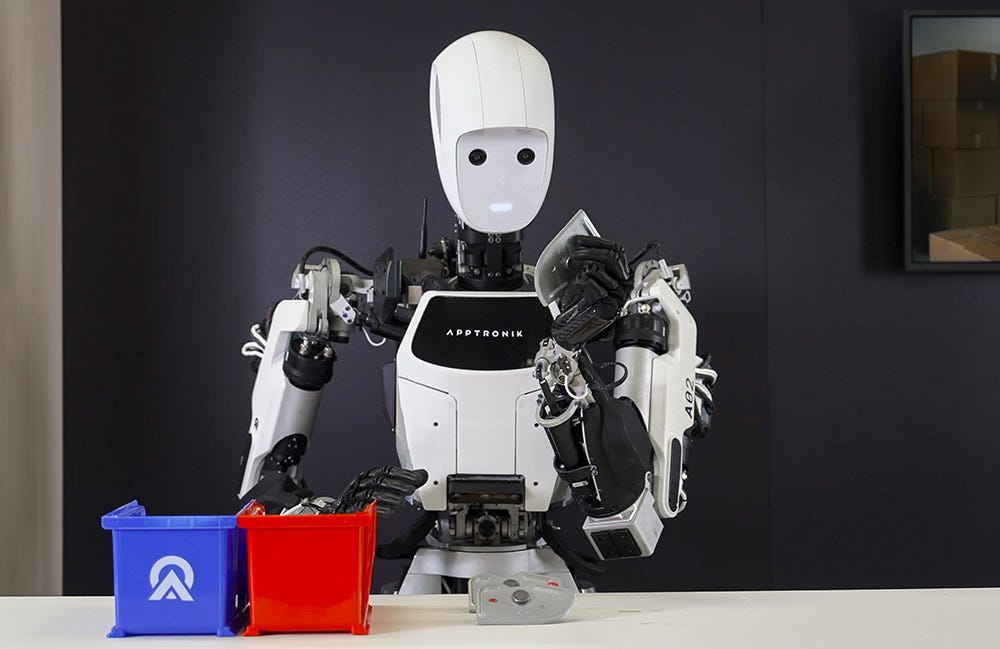

Why Humanoid Robots Are the Future

Humanoid robots address labor shortages across industries, with market analysts projecting a trillion-dollar industry by 2035. 1X’s NEO, with its human-like dexterity, can perform tasks like assembling furniture or assisting in healthcare, unlike warehouse bots limited to moving pallets. This versatility makes 1X a leader in the Robotics Companies Stock race.

Investment Insights: Why Choose 1X Robotics Stock?

Investors seeking exposure to the robotics boom should prioritize companies with real-world deployment potential. 1X’s focus on AI Mobility, Energy Efficiency, and its OpenAI Partnership make it a compelling choice. While IRBT and TER offer stability, their limited adaptability and high valuations pose risks. 1X’s innovative approach and scalable technology position it as a disruptor in the AI mobility race.

Frequently Asked Questions

1. What makes 1X Robotics Stock different from other Robotics Companies Stock?

1X stands out due to its focus on humanoid robots with advanced AI Mobility and Energy Efficiency. Its OpenAI Partnership enhances learning capabilities, making its robots more adaptable than competitors like IRBT and TER.

2. How does 1X’s Energy Efficiency impact its investment potential?

1X’s robots use 30% less power than competitors, reducing operational costs and appealing to industries prioritizing sustainability. This efficiency strengthens 1X’s scalability and long-term profitability.

3. Is the OpenAI Partnership a significant advantage for 1X?

Yes, the OpenAI Partnership equips 1X robots with cutting-edge AI, enabling them to process complex instructions and adapt to diverse environments, unlike competitors’ less advanced software.

4. Are warehouse bots a risky investment compared to 1X Robotics Stock?

Warehouse bots, like those from Teradyne, are limited to structured environments and face high energy costs. 1X’s humanoid robots offer broader applications, reducing the risk of over-specialization.