Discover how AI Car Insurance is revolutionizing the auto coverage industry. Insurers now leverage machine learning for precise risk assessment, dynamic pricing, and lightning-fast claims processing. With usage-based programs powered by telematics, 24/7 chatbot support, and advanced fraud detection, policyholders enjoy personalized premiums while insurers cut costs. Learn why AI Car solutions are the future of auto insurance.

AI Car Risk Assessment: Smarter Underwriting

Traditional underwriting relies on broad demographics, leaving many drivers overpaying. Now, AI Car platforms analyze driving behavior in real time. By ingesting telematics, weather, and traffic data, machine learning models accurately predict risk. This shift means safe drivers get rewarded immediately.

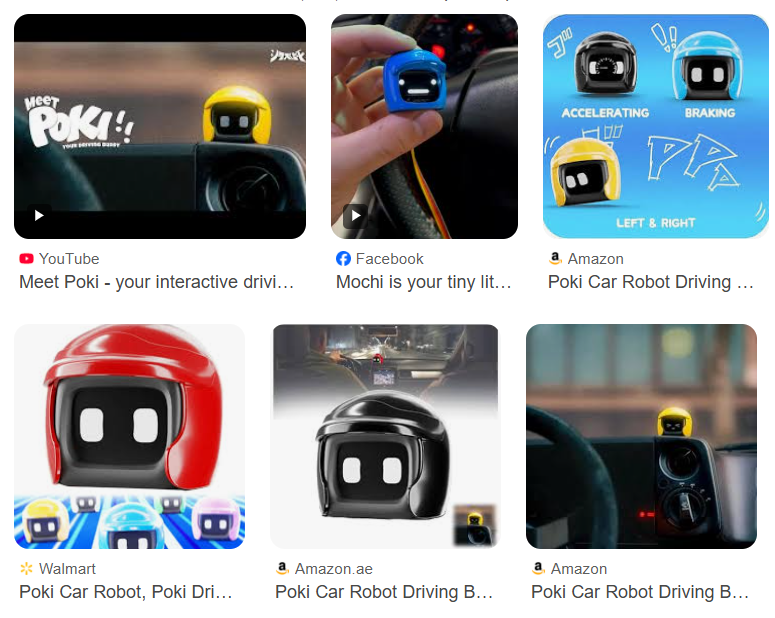

Insurers use sensors and smartphone apps to track acceleration, braking, and cornering. When coupled with self driving technology trends, data becomes richer. The result? Precise premiums that reflect true individual risk, not crude averages.

Expert Insight

“Machine learning in auto insurance transforms underwriting from art to science,” says Jane Liu, Chief Data Scientist at AutoTech Innovations. “We’ve seen a 25% reduction in loss ratios among policyholders tracked via telematics.”

Dynamic Pricing with AI Car & Telematics

Usage-Based Insurance (UBI) programs adjust premiums based on actual miles driven and driving style. With AI Car algorithms, insurers can offer “pay-as-you-drive” or “pay-how-you-drive” plans. This real-time pricing empowers policyholders to reduce costs by adopting safer habits.

Telematics devices collect GPS and OBD-II data, feeding into neural networks. Over time, the system learns driving patterns, flagging risky maneuvers. As a result, responsible drivers can see up to 30% savings on their premiums.

Automated Claims & Chatbot Support

Filing a claim used to be a slow, paperwork-heavy ordeal. Today, AI Car Insurance platforms use image recognition to inspect vehicle damage instantly. Policyholders upload photos, and AI estimates repair costs within minutes.

24/7 chatbots handle routine inquiries, from coverage questions to policy changes. Combining natural language processing with underwriting rules, these AI Cars assistants resolve over 70% of queries without human intervention.

Case Study

At DriveSafe Insurance, deploying an AI claims bot reduced processing times from 5 days to under 2 hours. Customer satisfaction scores jumped by 40% within three months of launch.

Fraud Detection & Prevention

Fraud costs insurers billions annually. By applying deep learning to historical claims and social media data, AI Car systems flag suspicious activity automatically. Unusual patterns trigger human review, slashing false payouts.

Early adopters report a 50% drop in fraudulent claims, thanks to predictive models. This not only protects insurers but also keeps premiums lower for honest drivers.

The Benefits of AI Car Insurance for Consumers

Personalized premiums based on actual driving data.

Convenient claims filing with instant damage estimates.

24/7 support via intelligent chatbots.

Enhanced transparency and fairer pricing.

As autonomous vehicles and self driving car technologies mature, the role of AI Car in insurance will only grow. Consumers can look forward to further innovations like real-time risk alerts and proactive safety coaching.

FAQs

1. What is AI Car Insurance?

AI Car Insurance uses machine learning and data analytics to underwrite, price, and process claims automatically, making coverage more personalized and efficient.

2. How does usage-based pricing work?

Telematics devices record driving metrics like speed and braking. AI models analyze these behaviors to adjust premiums in real time, rewarding safe drivers.

3. Are my data and privacy safe?

Insurers implement strong encryption and anonymization protocols. Drivers can often opt in or out of usage-based programs, maintaining control over their data.

4. Can AI Car Insurance detect fraud?

Yes. By analyzing vast datasets and patterns, AI systems flag suspicious claims for review, reducing fraud losses significantly.