Government finance directors, city managers, and public sector administrators struggle with outdated legacy systems that create inefficiencies in budget planning, financial reporting, and resource allocation processes. Traditional government ERP systems often require months to generate comprehensive budget reports, lack real-time visibility into departmental spending, and demand extensive manual data entry that increases error rates and administrative burden. Public sector organizations face growing pressure to demonstrate fiscal responsibility while delivering essential services with limited resources and increasing transparency requirements. Citizens and oversight bodies demand timely, accurate financial reporting that traditional systems cannot provide efficiently. This detailed examination reveals how OpenGov's cloud-based ERP platform leverages advanced AI tools to transform government financial management through automated budgeting processes, intelligent reporting systems, and predictive analytics that enhance decision-making capabilities while reducing administrative overhead and improving public accountability.

The Public Sector Technology Challenge

Government organizations operate under unique constraints that distinguish them from private sector entities. Public sector financial management requires compliance with complex regulations, adherence to strict audit requirements, and transparency standards that exceed typical business needs. Traditional government systems often rely on decades-old technology that creates silos between departments and limits real-time financial visibility.

OpenGov addresses these challenges through modern cloud-based architecture and sophisticated AI tools designed specifically for government operations. The platform eliminates the technical debt associated with legacy systems while providing the security, compliance, and functionality that public sector organizations require.

Intelligent Budget Development and Planning

H2: Automated Budget Creation Through Advanced AI Tools

OpenGov's budget management capabilities transform the traditional budget development process from a months-long manual exercise into an efficient, data-driven workflow. The AI tools analyze historical spending patterns, revenue trends, and departmental needs to generate preliminary budget frameworks that serve as starting points for detailed planning discussions.

The automated budget creation process considers multiple variables including population growth, economic indicators, service demand patterns, and regulatory requirements. OpenGov's AI tools can identify spending anomalies, predict future needs, and recommend budget allocations that optimize resource distribution across departments and programs.

H3: Predictive Analytics and Scenario Planning

Advanced forecasting capabilities within OpenGov's AI tools enable government organizations to model different budget scenarios and assess the potential impact of policy decisions. The system can simulate the effects of tax rate changes, service level modifications, and capital investment decisions on long-term financial sustainability.

The scenario planning features include sensitivity analysis that shows how changes in key assumptions affect budget outcomes. OpenGov's AI tools provide confidence intervals and risk assessments that help decision-makers understand the potential variability in budget projections and plan accordingly.

Financial Management and Operational Efficiency

H2: Real-Time Financial Monitoring with AI Tools

OpenGov's financial management system provides continuous monitoring of government operations through real-time dashboards and automated alerts. The AI tools track spending against budgets, identify potential overruns, and flag unusual transactions that require attention. This continuous monitoring enables proactive financial management rather than reactive responses to problems.

The real-time monitoring capabilities extend to revenue tracking, where OpenGov's AI tools analyze collection patterns, identify trends, and predict cash flow requirements. This comprehensive financial visibility enables better decision-making and helps prevent budget shortfalls before they become critical issues.

H3: Intelligent Transaction Processing and Approval Workflows

Automated transaction processing features streamline routine financial operations while maintaining appropriate controls and audit trails. OpenGov's AI tools can categorize expenses, route approvals, and flag transactions that require additional review based on predefined criteria and machine learning algorithms.

The intelligent workflow system adapts to organizational patterns and learns from user behavior to optimize approval processes. This automation reduces processing time while maintaining the controls and documentation required for government financial management.

Automated Reporting and Compliance Management

H2: Comprehensive Report Generation Using AI Tools

OpenGov's reporting capabilities address the complex requirements of government financial reporting through automated generation of standard reports, custom analyses, and regulatory filings. The AI tools can compile data from multiple sources, apply appropriate formatting, and generate reports that meet specific compliance requirements without manual intervention.

The automated reporting process includes validation checks that ensure data accuracy and completeness before report generation. OpenGov's AI tools can identify inconsistencies, missing information, and potential errors that might compromise report quality or compliance status.

H3: Regulatory Compliance and Audit Preparation

Advanced compliance features within OpenGov's AI tools maintain continuous audit readiness through automated documentation, transaction tracking, and control monitoring. The system generates audit trails, maintains supporting documentation, and provides the transparency required for government financial oversight.

The audit preparation capabilities include automated workpaper generation, exception reporting, and compliance checklists that streamline the audit process. OpenGov's AI tools can identify potential audit issues before they become problems and provide the documentation needed to address auditor questions efficiently.

Performance Metrics and Operational Comparison

| Financial Process | Traditional Systems | OpenGov AI Tools | Efficiency Improvement |

|---|---|---|---|

| Budget Preparation Time | 4-6 months | 6-8 weeks | 60% time reduction |

| Monthly Report Generation | 2-3 weeks | 1-2 days | 85% faster delivery |

| Transaction Processing | Manual entry required | Automated workflows | 70% processing speed |

| Audit Preparation | 3-4 months | 3-4 weeks | 75% time savings |

| Budget Variance Analysis | Quarterly reviews | Real-time monitoring | Continuous visibility |

| Compliance Reporting | Manual compilation | Automated generation | 90% effort reduction |

| Data Accuracy Rate | 85-90% | 95-98% | 10% improvement |

The performance comparison illustrates significant improvements in efficiency, accuracy, and timeliness when government organizations implement OpenGov's AI tools compared to traditional financial management systems. These improvements enable better resource allocation and enhanced public service delivery.

Cloud Infrastructure and Security Framework

H2: Secure Cloud Architecture for Government AI Tools

OpenGov's cloud-based infrastructure provides the security, reliability, and scalability required for government operations. The AI tools operate within a secure environment that meets federal security standards and provides the data protection required for sensitive government information.

The cloud architecture includes redundant systems, automated backups, and disaster recovery capabilities that ensure continuous operations even during emergencies. OpenGov's AI tools benefit from cloud scalability that can accommodate varying workloads and seasonal demands without requiring additional infrastructure investments.

H3: Data Security and Privacy Protection

Comprehensive security measures protect government data through encryption, access controls, and monitoring systems that detect and prevent unauthorized access. OpenGov's AI tools operate within security frameworks that meet government standards while providing the functionality needed for effective financial management.

The privacy protection features include data anonymization, audit logging, and user access controls that ensure appropriate data handling while enabling the AI tools to provide valuable insights and automation capabilities.

Integration Capabilities and System Connectivity

H2: Seamless Integration with Existing Government Systems Using AI Tools

OpenGov provides extensive integration capabilities that connect with existing government systems including payroll, procurement, and citizen service platforms. The AI tools facilitate data exchange between systems while maintaining data integrity and security standards required for government operations.

The integration features include API connectivity, data mapping tools, and automated synchronization that eliminates manual data entry and reduces the risk of errors. OpenGov's AI tools can work with legacy systems while providing modern functionality and user experiences.

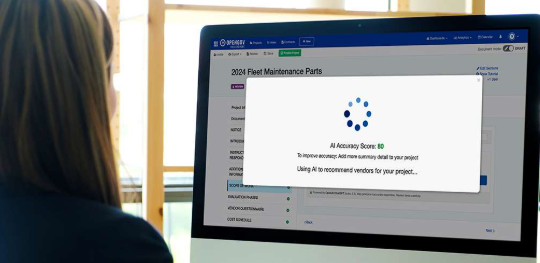

H3: Vendor Management and Procurement Integration

Advanced procurement integration capabilities enable seamless connection with vendor management systems and purchasing platforms. OpenGov's AI tools can track purchase orders, monitor contract compliance, and integrate payment processing with budget management and financial reporting systems.

Citizen Engagement and Transparency Features

H2: Public Financial Transparency Through AI Tools

OpenGov's transparency features enable government organizations to share financial information with citizens through user-friendly dashboards and interactive reports. The AI tools can generate public-facing reports that explain budget allocations, spending patterns, and performance metrics in accessible formats.

The citizen engagement capabilities include budget visualization tools, spending comparisons, and performance dashboards that help citizens understand how their tax dollars are being used. OpenGov's AI tools can create compelling presentations that communicate complex financial information effectively.

H3: Interactive Budget Participation and Feedback

Citizen participation features enable public input on budget priorities and spending decisions through online platforms and interactive tools. OpenGov's AI tools can analyze citizen feedback, identify common themes, and provide insights that inform budget decision-making processes.

Training and Implementation Support

H2: Comprehensive Training Programs for AI Tools Adoption

OpenGov provides extensive training and support resources that help government organizations successfully implement and utilize AI tools for financial management. The company offers role-based training programs, certification courses, and ongoing support that ensure effective platform adoption.

The training curriculum covers system functionality, best practices, and change management strategies that help organizations transition from legacy systems to modern AI-powered financial management. OpenGov's AI tools include built-in help systems and guided workflows that support user adoption and proficiency development.

H3: Change Management and Organizational Development

Professional change management support helps government organizations navigate the transition to AI-powered financial management systems. OpenGov provides consulting services, implementation planning, and organizational development support that ensures successful technology adoption.

Performance Analytics and Benchmarking

H2: Advanced Analytics and Performance Measurement with AI Tools

OpenGov's analytics capabilities provide government organizations with insights into operational performance, financial trends, and service delivery effectiveness. The AI tools can identify patterns, predict outcomes, and recommend improvements that enhance government operations and citizen services.

The performance measurement features include benchmarking capabilities that compare organizational performance against peer jurisdictions and industry standards. OpenGov's AI tools provide context for performance metrics and identify opportunities for improvement and best practice adoption.

H3: Predictive Modeling and Trend Analysis

Sophisticated modeling capabilities enable government organizations to anticipate future challenges and opportunities through predictive analytics and trend analysis. OpenGov's AI tools can forecast revenue patterns, predict service demand, and identify potential issues before they impact operations.

Frequently Asked Questions About AI Tools

Q: How do OpenGov's AI tools ensure compliance with government accounting standards and regulations?A: OpenGov's AI tools are specifically designed to meet government accounting standards including GASB requirements and federal compliance regulations. The system includes built-in controls, automated compliance checks, and audit trails that ensure adherence to regulatory requirements while streamlining compliance processes and reducing manual oversight burden.

Q: Can AI tools handle the complex budget structures and fund accounting required by government organizations?A: Yes, OpenGov's AI tools are designed specifically for government fund accounting and can handle complex budget structures including multiple funds, grants, and restricted revenue sources. The system automatically applies appropriate accounting rules, tracks fund balances, and ensures compliance with legal restrictions on fund usage while providing comprehensive reporting capabilities.

Q: How do AI tools protect sensitive government financial data while providing necessary functionality?A: OpenGov's AI tools operate within a secure cloud infrastructure that meets federal security standards including FedRAMP authorization. The system includes encryption, access controls, audit logging, and data anonymization features that protect sensitive information while enabling AI functionality for budgeting, reporting, and analytics without compromising security.

Q: What level of customization do AI tools provide for different types of government organizations?A: OpenGov's AI tools offer extensive customization options that accommodate different government structures including municipalities, counties, school districts, and special districts. The system can be configured to match specific organizational needs, reporting requirements, and workflow preferences while maintaining core AI functionality and compliance capabilities.

Q: How do AI tools integrate with existing government systems and legacy databases?A: OpenGov provides comprehensive integration capabilities including API connectivity, data mapping tools, and automated synchronization that enable seamless connection with existing government systems. The AI tools can work with legacy systems while providing modern functionality, ensuring data consistency, and eliminating duplicate data entry requirements.