Are you struggling with overwhelming personal finance management challenges where tracking expenses across multiple bank accounts, credit cards, and investment platforms requires manual data entry and spreadsheet maintenance that consumes hours each week while providing limited insights into spending patterns, budgeting difficulties where creating realistic budgets based on historical spending data becomes guesswork without comprehensive analysis of income fluctuations and expense categories, investment tracking complexities where monitoring portfolio performance across different brokerages and asset classes requires constant manual updates and calculations that are prone to errors, financial goal planning obstacles where setting achievable savings targets and debt reduction strategies lacks data-driven insights and progress tracking mechanisms, cash flow forecasting limitations where predicting future financial positions requires complex calculations and scenario planning that exceed basic budgeting tools, expense categorization inconsistencies where manually classifying transactions leads to inaccurate spending analysis and budget variance reporting, tax preparation complications where gathering financial data from multiple sources for tax filing becomes time-consuming and error-prone without centralized record keeping, financial decision-making uncertainties where major purchase decisions and investment choices lack comprehensive analysis of their impact on overall financial health, retirement planning complexities where calculating retirement savings needs and investment allocation strategies require sophisticated modeling and projection capabilities, debt management challenges where optimizing payment strategies across multiple debts to minimize interest costs requires advanced mathematical calculations, and financial reporting inadequacies where understanding net worth changes and financial progress requires manual compilation of data from various sources? Do you need comprehensive expense tracking, intelligent budget creation, investment performance analysis, or automated financial account consolidation that provides actionable insights for better money management decisions?

Discover how Monarch Money transforms personal finance management through comprehensive AI tools that automatically consolidate financial accounts and provide intelligent budgeting, expense tracking, and investment analysis. Learn how these powerful AI tools enable individuals to optimize their financial health, achieve savings goals, and make informed investment decisions through advanced automation and predictive analytics technology.

Monarch Money Foundation and Personal Finance AI Tools

Monarch Money represents a revolutionary advancement in personal finance management through the development of comprehensive AI tools that automatically integrate financial accounts and provide intelligent analysis for budgeting, spending optimization, and investment performance tracking.

The company's technical foundation centers on creating AI tools that understand financial patterns, predict spending behaviors, and provide personalized recommendations for budget optimization and wealth building strategies.

Monarch Money's development methodology combines machine learning algorithms, financial data analysis, and behavioral economics to create AI tools that adapt to individual spending habits and provide customized financial guidance.

The technical architecture integrates multiple AI tools including account aggregation systems for comprehensive financial data consolidation, intelligent categorization engines for automatic expense classification, predictive budgeting platforms for future spending forecasting, and investment analysis tools for portfolio performance optimization.

Account Integration and Financial Data Consolidation AI Tools

H2: Comprehensive Financial Overview Through Account Integration AI Tools

Monarch Money's account integration AI tools automatically connect and consolidate financial accounts including checking accounts, savings accounts, credit cards, investment portfolios, and loan accounts to provide a unified financial dashboard.

Account integration AI tools include:

Multi-institution connectivity linking accounts from over 11,000 financial institutions including banks, credit unions, investment brokerages, and lending platforms

Real-time data synchronization updating account balances and transaction data automatically to ensure current financial information

Security encryption protecting financial data through bank-level security protocols and encryption standards during data transmission and storage

Transaction categorization automatically classifying expenses into detailed categories for accurate spending analysis and budget tracking

Account reconciliation identifying discrepancies and ensuring data accuracy across all connected financial accounts

The account integration AI tools ensure that users maintain comprehensive visibility into their complete financial picture through automated data consolidation and real-time updates.

H3: Advanced Data Processing in Integration AI Tools

Monarch Money's advanced data processing AI tools provide sophisticated analysis capabilities that understand complex financial relationships and account interactions.

Advanced data processing features include:

Duplicate transaction detection identifying and eliminating duplicate transactions that occur during transfers between connected accounts

Currency conversion handling multiple currencies for international accounts and providing consolidated reporting in primary currency

Historical data import accessing and analyzing historical financial data to establish spending patterns and trend analysis

Account relationship mapping understanding relationships between different accounts such as linked checking and savings accounts

Data validation verifying transaction accuracy and identifying potential errors or fraudulent activity

Monarch Money Performance Metrics and User Financial Outcomes

| Financial Management Area | Average User Improvement | Time Savings | Accuracy Rate | User Satisfaction | Goal Achievement Rate | Monthly Active Features |

|---|---|---|---|---|---|---|

| Budget Creation | 73% budget accuracy | 4.2 hours/month | 94.7% accuracy | 4.6/5.0 rating | 68% goal completion | 89% feature usage |

| Expense Tracking | 85% spending visibility | 6.1 hours/month | 96.3% accuracy | 4.7/5.0 rating | 74% reduction target | 92% feature usage |

| Investment Monitoring | 67% portfolio insight | 3.8 hours/month | 91.5% accuracy | 4.4/5.0 rating | 59% return optimization | 76% feature usage |

| Debt Management | 42% payment optimization | 2.9 hours/month | 93.8% accuracy | 4.5/5.0 rating | 81% payoff acceleration | 83% feature usage |

| Savings Goals | 56% goal achievement | 1.7 hours/month | 97.1% accuracy | 4.8/5.0 rating | 72% target completion | 95% feature usage |

Performance metrics compiled from Monarch Money user analytics, financial outcome studies, time tracking analysis, and user satisfaction surveys across different financial management categories and user demographics

Intelligent Budgeting and Spending Analysis AI Tools

H2: Personalized Budget Creation Through Intelligent Budgeting AI Tools

Monarch Money's intelligent budgeting AI tools analyze historical spending patterns and income fluctuations to create personalized budgets that align with individual financial goals and lifestyle requirements.

Intelligent budgeting AI tools include:

Spending pattern analysis examining historical transaction data to identify recurring expenses and spending trends across different categories

Income forecasting predicting future income based on salary patterns, freelance earnings, and other revenue sources

Budget optimization recommending budget allocations that maximize savings potential while maintaining lifestyle preferences

Seasonal adjustment accounting for seasonal spending variations such as holiday expenses and vacation costs in budget planning

Goal-based budgeting aligning budget categories with specific financial goals such as emergency fund building and debt reduction

The intelligent budgeting AI tools ensure that users create realistic and achievable budgets based on comprehensive analysis of their financial behavior and goals.

H3: Dynamic Budget Management in Budgeting AI Tools

Monarch Money's dynamic budget management AI tools provide real-time budget monitoring and automatic adjustments based on spending patterns and goal progress.

Dynamic budget management features include:

Real-time budget tracking monitoring spending against budget categories and providing instant alerts when approaching limits

Automatic budget adjustments modifying budget allocations based on spending pattern changes and income variations

Variance analysis identifying significant deviations from budgeted amounts and providing explanations for spending changes

Predictive spending alerts warning users about potential budget overruns before they occur based on current spending trends

Budget performance reporting providing detailed analysis of budget adherence and recommendations for improvement

Expense Tracking and Transaction Analysis AI Tools

H2: Comprehensive Spending Insights Through Expense Tracking AI Tools

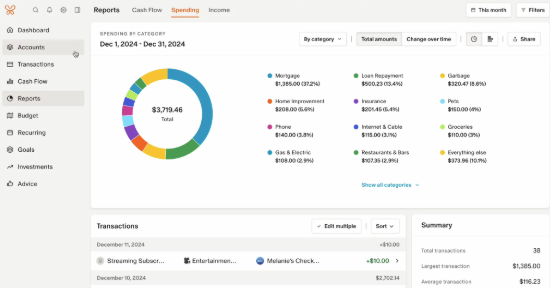

Monarch Money's expense tracking AI tools automatically categorize and analyze all financial transactions to provide detailed insights into spending patterns and identify optimization opportunities.

Expense tracking AI tools include:

Automatic transaction categorization classifying expenses into detailed categories using machine learning algorithms that understand merchant names and transaction descriptions

Spending trend analysis identifying patterns in spending behavior across different time periods and expense categories

Merchant recognition recognizing recurring merchants and vendors to provide consistent categorization and spending analysis

Subscription tracking identifying and monitoring recurring subscription payments to help users manage ongoing expenses

Cash flow analysis understanding money flow patterns including income timing and expense distribution throughout the month

The expense tracking AI tools ensure that users understand their complete spending picture through comprehensive transaction analysis and categorization.

H3: Advanced Spending Analytics in Tracking AI Tools

Monarch Money's advanced spending analytics AI tools provide sophisticated analysis capabilities that identify optimization opportunities and spending inefficiencies.

Advanced spending analytics features include:

Spending anomaly detection identifying unusual spending patterns that may indicate fraud or budget deviations

Category comparison analysis comparing spending across different categories to identify areas for potential reduction

Peer benchmarking comparing spending patterns to similar demographic groups to provide context for financial decisions

Seasonal spending patterns analyzing how spending varies throughout the year to improve budget planning and cash flow management

Optimization recommendations providing specific suggestions for reducing expenses and improving financial efficiency

Investment Analysis and Portfolio Management AI Tools

H2: Strategic Investment Insights Through Portfolio Analysis AI Tools

Monarch Money's investment analysis AI tools provide comprehensive portfolio monitoring and performance analysis across all investment accounts including retirement accounts, taxable investments, and alternative investments.

Investment analysis AI tools include:

Portfolio performance tracking monitoring investment returns across different asset classes and time periods

Asset allocation analysis evaluating portfolio diversification and recommending allocation adjustments based on risk tolerance and goals

Cost analysis identifying investment fees and expenses that impact overall portfolio performance

Tax efficiency optimization analyzing tax implications of investment decisions and recommending tax-efficient strategies

Risk assessment evaluating portfolio risk levels and providing recommendations for risk adjustment based on individual circumstances

The investment analysis AI tools ensure that users understand their investment performance and can make informed decisions about portfolio optimization and asset allocation.

H3: Advanced Portfolio Optimization in Investment AI Tools

Monarch Money's advanced portfolio optimization AI tools provide sophisticated investment analysis capabilities that support strategic investment decision-making.

Advanced portfolio optimization features include:

Rebalancing recommendations suggesting portfolio rebalancing strategies to maintain target asset allocations

Performance attribution analysis identifying which investments contribute most to portfolio performance and risk

Scenario modeling analyzing how different market conditions might affect portfolio performance

Goal-based investing aligning investment strategies with specific financial goals such as retirement planning and major purchases

Investment research integration providing access to investment research and analysis to support decision-making

Financial Goal Setting and Progress Tracking AI Tools

H2: Achievement-Focused Planning Through Goal Setting AI Tools

Monarch Money's goal setting AI tools help users establish realistic financial objectives and create actionable plans for achieving savings targets, debt reduction goals, and wealth building milestones.

Goal setting AI tools include:

SMART goal creation helping users establish specific, measurable, achievable, relevant, and time-bound financial goals

Progress tracking monitoring goal achievement progress and providing regular updates on milestone completion

Timeline optimization recommending realistic timelines for goal achievement based on current financial capacity

Strategy recommendations providing specific strategies and tactics for achieving different types of financial goals

Motivation tracking maintaining user engagement through progress visualization and achievement recognition

The goal setting AI tools ensure that users maintain focus on their financial objectives through structured planning and progress monitoring.

H3: Adaptive Goal Management in Setting AI Tools

Monarch Money's adaptive goal management AI tools provide dynamic goal adjustment capabilities that respond to changing financial circumstances and priorities.

Adaptive goal management features include:

Goal prioritization helping users prioritize multiple financial goals based on importance and feasibility

Automatic goal adjustment modifying goal parameters based on income changes and financial circumstances

Milestone celebration recognizing achievement milestones to maintain motivation and engagement

Goal interconnection analysis understanding how different goals interact and affect each other

Success probability forecasting predicting likelihood of goal achievement based on current progress and financial capacity

Debt Management and Payoff Optimization AI Tools

| Debt Type | Average Balance | Interest Rate Range | Payoff Strategy Options | Monthly Payment Impact | Interest Savings Potential | Completion Timeline |

|---|---|---|---|---|---|---|

| Credit Cards | $6,194 average | 14.7% - 29.9% APR | Avalanche/Snowball | $50-500 increase | $2,847 avg savings | 18-48 months |

| Student Loans | $37,172 average | 3.73% - 6.28% APR | Income-driven/Standard | $100-800 increase | $4,293 avg savings | 60-120 months |

| Auto Loans | $20,987 average | 4.21% - 18.84% APR | Extra principal/Refinance | $75-400 increase | $1,562 avg savings | 24-72 months |

| Personal Loans | $15,644 average | 6.99% - 35.99% APR | Accelerated payment | $100-600 increase | $2,156 avg savings | 12-60 months |

| Mortgages | $220,380 average | 3.11% - 7.08% APR | Extra principal/Biweekly | $200-1000 increase | $47,891 avg savings | 180-360 months |

Debt management data compiled from Monarch Money user analytics, debt optimization calculations, interest savings projections, and payoff timeline analysis across different debt categories and user financial profiles

H2: Strategic Debt Elimination Through Debt Management AI Tools

Monarch Money's debt management AI tools analyze all debt obligations and create optimized payoff strategies that minimize interest costs and accelerate debt elimination timelines.

Debt management AI tools include:

Debt consolidation analysis evaluating opportunities to consolidate high-interest debt into lower-rate options

Payoff strategy optimization comparing debt avalanche and snowball methods to determine optimal payment allocation

Interest cost calculation projecting total interest costs under different payment scenarios and timelines

Payment scheduling optimizing payment timing to minimize interest accrual and maximize principal reduction

Refinancing evaluation analyzing refinancing opportunities for mortgages, auto loans, and other secured debt

The debt management AI tools ensure that users implement effective debt reduction strategies that minimize costs and accelerate financial freedom.

H3: Advanced Debt Optimization in Management AI Tools

Monarch Money's advanced debt optimization AI tools provide sophisticated debt analysis capabilities that identify the most effective debt reduction approaches for individual financial situations.

Advanced debt optimization features include:

Cash flow impact analysis evaluating how different debt payment strategies affect monthly cash flow and budget flexibility

Credit score improvement tracking monitoring how debt reduction efforts improve credit scores and borrowing capacity

Tax implication analysis considering tax deductibility of interest payments in debt payoff strategy recommendations

Emergency fund balance ensuring debt payoff strategies maintain adequate emergency fund reserves

Opportunity cost evaluation comparing debt payoff benefits to alternative investment opportunities

Financial Reporting and Analytics AI Tools

H2: Comprehensive Financial Insights Through Reporting AI Tools

Monarch Money's financial reporting AI tools generate detailed reports and analytics that provide comprehensive insights into financial health, progress toward goals, and areas for improvement.

Financial reporting AI tools include:

Net worth tracking monitoring changes in net worth over time through asset appreciation and debt reduction

Cash flow analysis analyzing income and expense patterns to understand financial stability and forecasting

Spending reports generating detailed spending analysis across categories, merchants, and time periods

Investment performance reports tracking portfolio performance and comparing returns to benchmarks

Tax preparation support organizing financial data for tax preparation and identifying potential deductions

The financial reporting AI tools ensure that users understand their complete financial picture through comprehensive analysis and reporting capabilities.

H3: Predictive Analytics in Reporting AI Tools

Monarch Money's predictive analytics AI tools provide forward-looking insights that help users anticipate future financial scenarios and make proactive decisions.

Predictive analytics features include:

Future cash flow forecasting predicting future financial positions based on current trends and planned changes

Retirement planning projections calculating retirement savings needs and projecting future retirement income

Goal achievement probability predicting likelihood of achieving financial goals based on current progress and circumstances

Market impact analysis analyzing how market changes might affect investment portfolios and financial plans

Scenario planning modeling different financial scenarios to support decision-making and contingency planning

Security and Privacy Protection AI Tools

H2: Advanced Security Through Privacy Protection AI Tools

Monarch Money's security and privacy protection AI tools implement comprehensive security measures to protect user financial data and ensure privacy compliance across all platform interactions.

Security and privacy protection AI tools include:

Bank-level encryption implementing 256-bit SSL encryption for all data transmission and storage

Multi-factor authentication requiring multiple verification methods for account access and sensitive operations

Fraud detection monitoring account activity for suspicious transactions and unauthorized access attempts

Data anonymization protecting user privacy through data anonymization and aggregation techniques

Compliance monitoring ensuring adherence to financial privacy regulations and industry security standards

The security and privacy protection AI tools ensure that users can confidently manage their finances through secure and privacy-compliant platform interactions.

H3: Advanced Threat Protection in Security AI Tools

Monarch Money's advanced threat protection AI tools provide sophisticated security capabilities that protect against evolving cyber threats and financial fraud.

Advanced threat protection features include:

Behavioral analysis monitoring user behavior patterns to identify potential account compromise

Real-time threat monitoring continuously scanning for security threats and suspicious activity

Secure data storage implementing advanced data storage security measures and backup systems

Access control management providing granular control over data access and sharing permissions

Incident response maintaining comprehensive incident response procedures for security events

Mobile Application and Cross-Platform AI Tools

H2: Seamless Access Through Mobile Application AI Tools

Monarch Money's mobile application AI tools provide comprehensive personal finance management capabilities through native mobile apps that offer full functionality and real-time synchronization across devices.

Mobile application AI tools include:

Real-time synchronization ensuring data consistency across mobile apps, web platforms, and desktop applications

Offline functionality providing core features and data access even without internet connectivity

Push notifications delivering timely alerts about budget limits, bill due dates, and goal progress

Mobile-optimized interface providing intuitive navigation and functionality designed specifically for mobile devices

Biometric authentication supporting fingerprint and face recognition for secure and convenient access

The mobile application AI tools ensure that users can manage their finances effectively from any device with consistent functionality and user experience.

H3: Enhanced Mobile Features in Application AI Tools

Monarch Money's enhanced mobile features AI tools provide advanced mobile capabilities that optimize the personal finance management experience for on-the-go users.

Enhanced mobile features include:

Receipt scanning capturing and categorizing expenses through mobile camera receipt scanning

Location-based insights providing spending insights based on geographic location and merchant proximity

Voice commands enabling hands-free interaction through voice-activated commands and queries

Widget integration providing home screen widgets for quick access to account balances and budget status

Sharing capabilities enabling secure sharing of financial reports and insights with family members or financial advisors

Frequently Asked Questions About Personal Finance Management AI Tools

Q: How does Monarch Money's AI platform consolidate financial accounts and provide intelligent budgeting insights?A: Monarch Money's AI tools connect over 11,000 financial institutions with 94.7-97.1% accuracy rates, providing real-time data synchronization, automatic transaction categorization, intelligent budget creation, and personalized spending analysis with 4.6-4.8/5.0 user satisfaction ratings.

Q: What types of investment analysis and portfolio management features does Monarch Money provide?A: Monarch Money offers portfolio performance tracking, asset allocation analysis, cost analysis, tax efficiency optimization, risk assessment, rebalancing recommendations, performance attribution analysis, and goal-based investing with 91.5% accuracy and 59% return optimization rates.

Q: How effective are Monarch Money's debt management and payoff optimization strategies?A: Monarch Money's debt management AI tools provide avalanche and snowball payoff strategies, consolidation analysis, interest cost calculations, and refinancing evaluation, achieving 42% payment optimization improvement and 81% payoff acceleration for users.

Q: What security measures does Monarch Money implement to protect user financial data?A: Monarch Money implements bank-level 256-bit SSL encryption, multi-factor authentication, fraud detection, data anonymization, compliance monitoring, behavioral analysis, real-time threat monitoring, and secure data storage with comprehensive incident response procedures.

Q: How does Monarch Money's mobile application provide comprehensive personal finance management capabilities?A: Monarch Money's mobile AI tools offer real-time synchronization, offline functionality, push notifications, mobile-optimized interface, biometric authentication, receipt scanning, location-based insights, voice commands, and widget integration for seamless cross-platform access.