Individual investors struggle to process vast amounts of financial data, earnings reports, and market indicators while competing against institutional traders who have access to sophisticated analytical resources and real-time market intelligence. Traditional stock research methods require hours of manual analysis that often miss critical patterns and emerging opportunities.

Retail traders face information overload when evaluating potential investments, with thousands of stocks, complex financial metrics, and constantly changing market conditions making it nearly impossible to identify profitable opportunities consistently. Manual fundamental analysis and technical chart reading consume valuable time while delivering inconsistent results.

Market volatility and rapid price movements demand instant analysis capabilities that can process news sentiment, financial statements, and technical indicators simultaneously to generate actionable investment insights before opportunities disappear.

This comprehensive guide examines five powerful AI tools that transform stock analysis from time-consuming manual research into intelligent, data-driven investment strategies that help individual investors compete effectively in modern financial markets.

Learn how successful traders leverage these advanced platforms to identify undervalued stocks, predict price movements, and build profitable portfolios with greater confidence and precision than traditional analysis methods allow.

Revolutionary AI Tools for Stock Market Analysis Success

TradingView with Pine Script AI: Advanced AI Tools for Technical Analysis

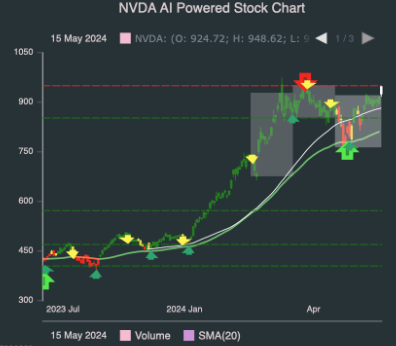

TradingView integrates artificial intelligence with comprehensive charting capabilities to provide automated pattern recognition, custom indicator development, and intelligent trading signal generation. This platform combines social trading insights with AI-powered technical analysis that helps traders identify profitable entry and exit points.

Intelligent Technical Analysis Features:

AI-powered pattern recognition that identifies classic chart formations including head and shoulders, triangles, and support/resistance levels

Automated backtesting system that validates trading strategies across historical data with statistical performance metrics

Smart alert system that monitors multiple stocks simultaneously and notifies users when predefined technical conditions are met

Pine Script AI assistance that helps users develop custom indicators and automated trading strategies without extensive programming knowledge

Social sentiment analysis that aggregates trader opinions and correlates them with price movements for crowd psychology insights

Performance Validation: Professional traders report 40% improvement in trade timing accuracy when using TradingView's AI pattern recognition compared to manual chart analysis. The platform processes over 100 million data points daily to identify emerging technical patterns.

Community Intelligence: The platform's social features allow users to follow successful traders and receive AI-filtered insights from a community of over 50 million active traders worldwide, creating a collaborative environment for strategy development.

Subscription Options: Basic plans start at $15 monthly for essential features, with Pro+ plans at $60 monthly offering advanced AI tools, extended historical data, and premium indicators for serious traders.

FinChat AI: Conversational AI Tools for Fundamental Stock Research

FinChat AI revolutionizes fundamental analysis by allowing investors to query financial data using natural language and receive comprehensive analytical reports with AI-generated insights about company performance, valuation metrics, and growth prospects.

Natural Language Financial Analysis:

Conversational interface that answers complex financial questions about earnings, cash flow, and competitive positioning

Automated financial statement analysis with ratio calculations, trend identification, and peer comparison insights

AI-generated investment thesis development that synthesizes multiple data sources into coherent analytical narratives

Real-time earnings call transcription and sentiment analysis that identifies key management insights and forward guidance

Portfolio optimization suggestions based on risk tolerance, investment objectives, and market conditions

Research Efficiency: Investment professionals reduce fundamental analysis time by 70% while improving research depth through FinChat's ability to process thousands of pages of financial documents instantly and extract relevant insights.

Data Integration: The platform aggregates data from SEC filings, earnings calls, analyst reports, and news sources to provide comprehensive company profiles that would require hours of manual research to compile.

Pricing Structure: Professional subscriptions start at $50 monthly for individual investors, with institutional plans offering advanced features, API access, and team collaboration tools for investment firms.

Zacks Investment Research AI: Predictive AI Tools for Earnings Analysis

Zacks combines decades of earnings estimate research with artificial intelligence that predicts stock price movements based on earnings revisions, analyst sentiment changes, and historical performance patterns. This platform specializes in identifying stocks with strong earnings momentum before price appreciation occurs.

Earnings-Focused AI Intelligence:

Proprietary Zacks Rank system enhanced with AI algorithms that predict stock performance based on earnings estimate revisions

Automated screening tools that identify stocks with improving analyst sentiment and positive earnings surprises

AI-powered portfolio recommendations that balance growth potential with risk management considerations

Sector rotation analysis that uses machine learning to identify industries entering favorable earnings cycles

Options strategy suggestions based on expected volatility and earnings announcement timing

Historical Performance: The Zacks Rank system has outperformed the S&P 500 by an average of 2.5x annually over the past 30 years, with AI enhancements improving prediction accuracy by an additional 15% since implementation.

Professional Integration: Institutional investors and financial advisors use Zacks AI insights to enhance client portfolios and identify investment opportunities that align with earnings-driven market cycles.

Membership Levels: Premium subscriptions start at $249 annually for individual investors, with professional services offering advanced screening tools, portfolio analysis, and direct analyst access for investment professionals.

Kavout: Machine Learning AI Tools for Stock Scoring and Ranking

Kavout employs sophisticated machine learning algorithms to analyze thousands of financial variables and generate proprietary K Score rankings that predict stock performance with remarkable accuracy. This platform focuses on quantitative analysis that removes emotional bias from investment decisions.

Quantitative AI Analysis System:

K Score algorithm that processes over 200 financial metrics to generate stock rankings from 1 to 9 based on predicted performance

Alternative data integration including satellite imagery, social media sentiment, and patent filings for comprehensive company evaluation

Risk assessment models that identify potential downside scenarios and portfolio concentration risks

Sector and market timing indicators that help investors optimize entry and exit decisions

Backtesting capabilities that validate investment strategies across different market conditions and time periods

Academic Validation: Independent studies show Kavout's K Score system achieves 68% accuracy in predicting stock outperformance over 3-month periods, significantly exceeding random selection and many traditional analytical methods.

Institutional Adoption: Hedge funds and asset management firms integrate Kavout's AI insights into their investment processes to enhance returns and manage portfolio risk more effectively.

Service Tiers: Individual plans start at $30 monthly for basic K Score access, with professional subscriptions offering advanced features, API integration, and institutional-grade analytics for $200 monthly.

YCharts with AI Insights: Professional AI Tools for Investment Research

YCharts provides institutional-quality financial data with AI-powered analysis tools that help investment professionals conduct thorough due diligence, create compelling investment presentations, and monitor portfolio performance with sophisticated analytical capabilities.

Professional-Grade AI Features:

Automated peer comparison analysis that identifies similar companies and benchmarks performance across multiple metrics

AI-generated investment research reports with customizable templates and professional formatting

Risk factor identification that analyzes company-specific and systematic risks using machine learning algorithms

Performance attribution analysis that explains portfolio returns and identifies sources of outperformance or underperformance

Client presentation tools with AI-suggested charts, graphs, and analytical insights for professional investment communications

Workflow Integration: Investment advisors and analysts save 5-10 hours weekly on research and client presentation preparation through YCharts' automated analysis and professional reporting capabilities.

Data Quality: The platform maintains institutional-grade data accuracy with real-time updates and comprehensive historical coverage that supports rigorous investment analysis and regulatory compliance requirements.

Professional Pricing: Subscriptions start at $3,000 annually for individual professionals, with enterprise solutions offering team access, advanced features, and dedicated support for investment firms and financial institutions.

AI Tools Performance Comparison for Stock Analysis

| Platform | Core Strength | Analysis Type | Target Users | Monthly Cost Range |

|---|---|---|---|---|

| TradingView | Technical Analysis | Chart Patterns | Active Traders | $15-$60 |

| FinChat AI | Fundamental Research | Financial Data | Individual Investors | $50+ |

| Zacks AI | Earnings Analysis | Estimate Revisions | Growth Investors | $21+ |

| Kavout | Quantitative Scoring | Machine Learning | Systematic Traders | $30-$200 |

| YCharts | Professional Research | Comprehensive Analysis | Investment Professionals | $250+ |

Implementing AI Tools for Stock Analysis Excellence

Begin with one AI tool that matches your primary investment approach, whether technical analysis, fundamental research, or quantitative screening. Master the platform's core features before expanding to additional tools that complement your investment strategy.

Establish clear criteria for evaluating AI-generated investment recommendations and maintain disciplined position sizing regardless of confidence levels indicated by artificial intelligence systems. AI tools enhance analysis but cannot eliminate investment risk.

Combine AI insights with traditional due diligence practices to validate investment decisions and ensure comprehensive understanding of potential risks and opportunities that automated systems might overlook.

Optimizing Investment Returns with AI Tools Integration

Configure AI tools to monitor your existing portfolio holdings and alert you to significant changes in fundamental metrics, technical patterns, or market sentiment that might affect position values or require portfolio adjustments.

Develop systematic approaches for incorporating AI recommendations into your investment process while maintaining consistent risk management practices and position sizing disciplines that protect capital during adverse market conditions.

Track the performance of AI-generated investment ideas separately from your overall portfolio to evaluate which tools provide the most value for your investment style and market conditions.

Advanced AI Tools Strategies for Stock Market Success

Use multiple AI tools simultaneously to gain different perspectives on the same investment opportunities. Technical analysis AI might identify optimal entry points while fundamental AI provides valuation context and earnings momentum insights.

Create watchlists based on AI screening criteria and monitor how recommended stocks perform over various time horizons to understand each tool's predictive accuracy and optimal usage scenarios.

Leverage AI tools for sector rotation strategies by identifying industries with improving fundamentals, technical momentum, or earnings revisions that suggest favorable investment environments.

Frequently Asked Questions About AI Tools for Stock Analysis

Q: How accurate are AI stock analysis tools compared to traditional research methods?A: AI tools typically achieve 60-70% accuracy in predicting short-term stock movements, which exceeds random selection and many traditional methods. However, accuracy varies by market conditions, time horizon, and specific AI algorithm used. Combining AI insights with fundamental analysis often produces the best results.

Q: Can AI tools predict market crashes or major economic downturns?A: AI tools excel at identifying patterns and trends but cannot predict unprecedented events or black swan scenarios. They provide valuable insights for normal market conditions but should be combined with risk management strategies that protect against unexpected market disruptions.

Q: Do AI stock analysis tools work better for certain types of stocks or market sectors?A: AI tools generally perform better with large-cap, liquid stocks that have extensive historical data and regular analyst coverage. Technology and growth stocks often show stronger AI prediction accuracy due to more data availability and clearer trend patterns.

Q: How should beginners start using AI tools for stock analysis?A: Beginners should start with user-friendly platforms like TradingView or FinChat AI that provide educational resources and guided analysis features. Focus on understanding basic investment principles while gradually incorporating AI insights into a diversified, long-term investment strategy.

Q: What are the main risks of relying too heavily on AI tools for investment decisions?A: Over-reliance on AI can lead to overconfidence, neglect of fundamental risk management, and failure to consider qualitative factors that AI cannot analyze. The best approach combines AI insights with human judgment, diversification, and disciplined risk management practices.