Introduction

Curious whether Suno AI is on the stock market? While not currently a public company, Suno AI has attracted significant attention—and serious investment. This article dives into the history, funding milestones, market positioning, and legal context around Suno AI stock. We'll also explore what this means if you’re considering how to invest in Suno AI in the future.

Company History & Growth Timeline

Founded in 2022 in Cambridge, Massachusetts, by Michael Shulman, Georg?Kucsko, Martin?Camacho, and Keenan?Freyberg, Suno began as an AI?audio tools developer named Bark, which launched in early 2023. That open?source project laid the groundwork for the company’s move into music.

By December 20, 2023, Suno released its flagship text-to-music app, along with a Microsoft Copilot plugin. On May 20, 2024, Suno launched version 3, offering extended song duration and refining vocal realism . A mobile app followed on July 1, 2024, and version 4.5 debuted in May 2025 .

Suno AI Funding & Valuation

Suno remains privately held—it’s not listed on any public exchange like NYSE or NASDAQ . Here's a breakdown of its financing to date:

Series?A: Raised (estimated) in March 2023; financial details not officially disclosed .

Series?B: Successfully secured $125?million in May 2024, led by Lightspeed Venture Partners, with participation from Matrix Partners, Founder Collective, Nat Friedman, and Daniel Gross .

Valuation: Post-money valuation hit approximately $500?million at Series?B.

Funding Total: Roughly $125?million raised overall.

Market Position & User Adoption

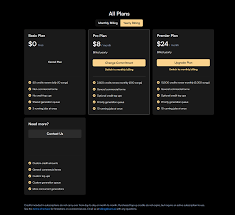

Since launch, Suno has amassed more than 12?million registered users by early 2025, with 10?million engaging in just months following Series B. The platform operates on a freemium model: free for limited song generation daily, with subscription tiers at $10/month for 500 songs or $30/month for 2,000 songs .

Regarding revenue, estimated ARR (annual recurring revenue) reached around $45?million at the time of Series B—at a revenue multiple of 11.1x on its valuation.

Despite its traction, Suno is still smaller compared to public AI players like SoundHound (ticker?SOUN), which reached a $3.66?billion market cap earlier this year.

Can You Buy Suno AI Stock Now?

No—Suno AI does not currently trade on any stock exchange .

How to gain exposure now:

Accredited investors can access pre?IPO shares through secondary markets like Forge Global, EquityZen, or Hiive.

Institutions and high-net-worth individuals may purchase shares from existing shareholders, such as early employees, depending on Suno’s transfer approval.

Legal & Industry Challenges

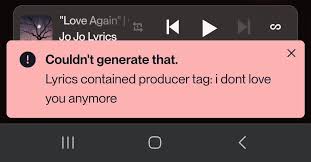

Suno is currently facing significant legal scrutiny. In June 2024, major labels Universal, Sony, and Warner, along with the RIAA, filed lawsuits alleging Suno illegally used copyrighted music in its training data . Suno maintains its training methods are "fair use," citing technological precedents.

Simultaneously, respected artists like Nick Cave, Tina?Arena, and Hans?Zimmer have voiced

Suno’s $500?million valuation, $45?million ARR, and rapid user growth make it a serious candidate for a future IPO. Legal clearance and structured licensing agreements with music rights holders would bolster its prospects.

However, competition in AI-generated music is intensifying. Companies like Udio, Amper Music, and AIVA are also scaling up. Public stock entry may offer Suno both capital and credibility—but timing and legal clarity will be key.

Conclusion

Suno AI is not publicly traded, and therefore has no stock ticker symbol .

It has raised $125?million, reaching a valuation close to $500?million at Series?B .

With 12?million users, a freemium-to-ARr model, and strong revenue, Suno is well-positioned to consider going public.

Legal battles over copyright remain a critical risk factor.

Accredited investors can pursue exposure via private pre?IPO platforms, but mainstream investors must wait for a potential public offering.

FAQs

Q1: Is Suno AI on the stock market?

No. It is privately held and not listed on any stock exchange .

Q2: What is Suno’s current valuation?

Approximately $500?million, based on Series?B funding in May 2024 .

Q3: Can I invest in Suno AI now?

Only accredited investors via secondary marketplaces like Forge, Hiive, or EquityZen.

Q4: How much revenue does Suno generate?

Estimated $45?million in ARR at the time of Series?B .

Q5: What are the main risks?

Key risks include ongoing copyright lawsuits and the fast?changing landscape of AI music generation.

Learn more about AI MUSIC TOOLS