The surge in Perplexity AI valuation has captured global attention, signaling the rapid rise of a new leader in the artificial intelligence landscape. Investors, entrepreneurs, and tech enthusiasts alike are eager to understand how Perplexity has achieved such growth, where it is heading, and what this means for the broader AI industry. In this article, we break down the company’s funding journey, key financial insights, competitors, and strategic opportunities to help investors stay informed in 2025 and beyond.

Why Perplexity AI Valuation Matters

Perplexity AI has quickly evolved from a niche startup into a serious competitor to industry giants like OpenAI, Anthropic, and Google DeepMind. Its valuation reflects not just current performance but also investor confidence in its long-term potential.

The Perplexity AI valuation is significant because it indicates how capital markets perceive the company’s role in shaping AI-driven search, conversational tools, and enterprise solutions. Investors often see valuation as a proxy for innovation, scalability, and market positioning.

?? Reflects market confidence in AI innovation

?? Determines startup competitiveness against established players

?? Helps investors identify growth opportunities in emerging AI markets

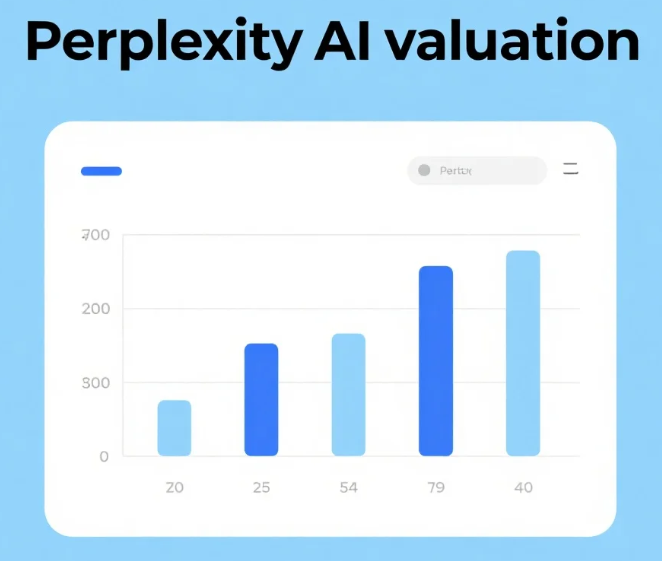

A Brief History of Perplexity AI's Funding Rounds

Understanding Perplexity AI valuation requires looking at its funding journey. Each investment round not only increased its valuation but also validated its strategic direction.

Early-stage funding focused on building a competitive AI-powered search platform.

Growth rounds saw backing from top venture capital firms and tech investors, signaling institutional confidence.

Recent valuations highlight strong demand from enterprise clients and global user adoption.

Unlike many startups that struggle to differentiate themselves, Perplexity AI positioned itself as a credible alternative to traditional search engines and AI chat tools. This clarity of vision significantly boosted investor enthusiasm.

How Valuation Compares with Competitors

To fully appreciate the rise in Perplexity AI valuation, it’s worth comparing it to other major AI firms. While OpenAI and Anthropic have achieved multibillion-dollar valuations, Perplexity’s surge is remarkable given its relatively young age.

The company benefits from a focused product strategy—an AI-powered search and conversational platform designed to deliver accurate, citation-rich answers. This differentiator helps it stand apart from chatbots that occasionally provide unreliable information.

?? OpenAI

Valued much higher but faces criticism for limited transparency and over-dependence on enterprise licensing deals.

? Perplexity AI

Leaner, more user-friendly, and trusted for fact-based, real-time answers that resonate with both businesses and individuals.

Key Drivers Behind Perplexity AI Valuation Growth

Several factors contribute to the company’s growing worth. Beyond user adoption, partnerships and strategic innovations have played crucial roles.

?? Strong User Base: Millions of users rely on Perplexity daily for research, content creation, and productivity.

?? Enterprise Expansion: Paid tiers and B2B integrations broaden revenue streams.

?? Technology Differentiation: Built-in citation system improves trust and credibility over competitors.

?? Global Appeal: Accessible to both Western and Asian markets, with multilingual support.

Investor Insights: Risks and Opportunities

While the Perplexity AI valuation shows optimism, investors should consider risks alongside opportunities. AI remains a fast-moving field, and new entrants can quickly disrupt the market.

On the upside, Perplexity’s growing user engagement and focus on factual accuracy present unique opportunities. Investors betting on AI-driven search engines may see Perplexity as one of the few platforms challenging traditional search monopolies.

"Perplexity AI’s valuation is not just about hype—it reflects a genuine shift in how people want to access reliable information online."

– Industry Analyst Commentary

Market Trends Influencing Valuation

The rise in Perplexity AI valuation also mirrors broader AI market trends. With global AI investments projected to exceed $300 billion by 2030, innovative platforms that focus on usability and transparency stand to benefit the most.

Investors are increasingly cautious about “hype-only” companies and prefer startups with clear revenue models and defensible technology. Perplexity’s balance between user growth and monetization strategies fits this demand perfectly.

Future Outlook for Perplexity AI

Looking forward, the Perplexity AI valuation may continue climbing if the company expands into enterprise-grade products and develops new revenue streams. Potential moves could include cloud-based integrations, data services, and premium research tools.

However, competition from tech giants remains a factor to watch. For Perplexity AI to sustain its momentum, it must continue innovating while preserving user trust through transparent and reliable answers.

Key Takeaways for Investors

Summary of Insights

? Perplexity AI valuation reflects both growth and strong investor confidence.

? Differentiation in accuracy and trustworthiness drives adoption.

? Future opportunities lie in enterprise solutions and monetization.

? Risks include rapid AI market shifts and strong competition.

Learn more about Perplexity AI